Sharing what I have learned supporting two atypical minds from childhood to adulthood.

Sunday, August 02, 2020

Special Needs CrossFit

Saturday, April 11, 2020

ABLE (529A) plans -- what's a good one and who has it

ABLE programs are similar to tax-advantaged 529 plans for college savings.[8] In addition, a 529 plan can be rolled over into an ABLE account for a qualified beneficiary.An ABLE account can be opened by a disabled individual who became disabled before 26 years of age.[8] An ABLE account can receive after-tax cash contributions from any person, including its owner.[1] Contributions in a year are limited to the federal gift tax exclusion [9] for that year — $15,000 in 2018.[10] If the beneficiary works and does not contribute to a 401(a), 401(k), 403(b), or 457 plan, the beneficiary can contribute an additional amount above that limit. The additional amount is equal to the lesser of the beneficiary's annual compensation or the federal poverty level for an individual — $12,060 in 2018.

- A debit or credit card tied to the account. I want self-documenting transactions. If #1 is buying a new iPhone I want that on the transaction record.

- Low fees

- Small management fees

- A quality web site

... 529 plans, especially ABLE accounts can only be administered by a state. When does a state see money and not figure out a way to skim off the top. The dirty little secret is that a significant portion of program management fees goes to the state. For example, Maryland and Oregon take 0.30% in administrative fees themselves in their 529 ABLE plans.

The best I have seen so far is LA ABLE for Louisiana state residents only. No annual fee, no program management fee and 0.07%-0.15% for six Vanguard funds, including the four LifeStrategy Funds. There is a state alliance of GA, KY, MO, NH, OH, SC, and VT that offers funds with asset based fees of 0.31%-0.34% for those state's residents (0.57%-0.60% non-residents).

For non-residents the National ABLE Alliance of AK, CO, DC, IL, IA, IN, KS, MN, MT, NC, NV, PA and RI. Offers funds with asset based fees of 0.34%-0.38%. Their program management management fee is 32% and I'm sure the states gets a significant chunk of that. The underlying expense ratios are 0.02%-0.06% (based on fixed portfolios using Vanguard, Schwab and iShares funds/ETFs). They have a $15 ($11.25 e-delivery)/qtr account fee.

The best plan for non-residents based on cost might be Tennessee's ABLE TN, offering Vanguard and DFA funds with asset based fees mostly in the range of 0.35%-037% (Wellington at 0.35%) with no account fees. As always the devil is in the details. E.g. the plan does not offer a debit card.

Ohio

- STABLE card: loadable prepaid debit card

- Vanguard

- $42/year maintenance fee

- Has debit card

- Fidelity Attainable Savings Plan

- No annual fees

- web site information unimpressive, doesn't explain how the prepaid card works

- has annual fee, does at least describe management fees on mutual funds (most sites don't do this)

Friday, November 22, 2019

Thanksgiving 2019 - update

I guess I gave away the story there. After about a year of working with a personal trainer who is also a CrossFit coach #1 joined my box. He has done better than my fondest hope. Not least because coaches have hit just the right tone ... friendly, supportive, but also treating him much like every other adult. Same for our athletes. The power of expectations is hard to overstate.

And ... special hockey volunteer, plays adult rec hockey with me, works with and rides horses, special olympics snowboarding, power lifting, golf, summer bicycling, works two part-time jobs ...

#2 had his best grade ever on a college exam. His studying is better. Started working in a minimum wage job filling popcorn bags but tells me he doesn't mind the boring work, likes using his hands, likes the money. Managed a challenging problem while working with a supportive teacher that would have melted him a year ago. Taken on a mentoring and support role with his special hockey colleagues. Continues his Tae Kwon Do training.

Both gentlemen are a pleasure to be with.

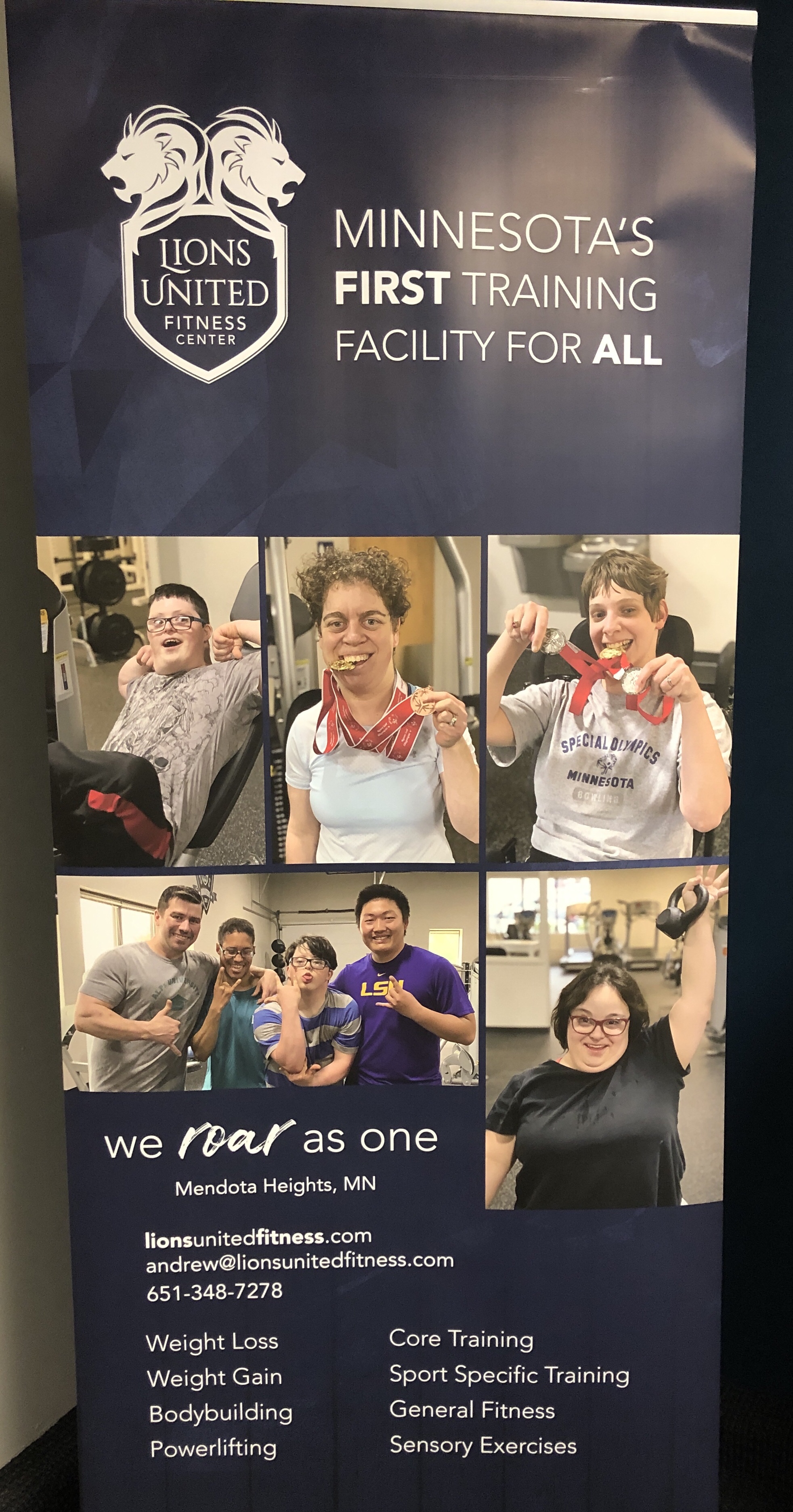

Twin Cities facility for special needs strength and fitness training

My #1 is doing their special Olympics strength training at Built on Bravery, located at the Mendota Height MN Lions United Fitness Center (map):

... Lions United is a new kind of training center, designed specifically to prepare people with disabilities for exceptional performance in individual competitions, team sports and life, especially people with autism, down syndrome and cerebral palsy. We’re dedicated to Special Olympics’ Project UNIFY and Unified Sports®, which means we bring people of all abilities together to strengthen individuals, relationships and communities....This new facility is first in Minnesota to focus on persons with cognitive disabilities.

The Star Tribune did an interview with the founder:

Q: Membership fees and hours?I think there may also be family memberships.

A: Twenty dollars a month for people with special needs; $40 a month for others. We’ll also have an incentive program where any member can receive up to $20 a month through their insurance. Staffed hours are Monday-Thursday, 3:30 p.m. to 10 p.m.; Friday 8 a.m. to 10 p.m.; Saturday and Sunday 8 a.m. to 6 p.m. But members will have 24-hour access.

There is a big unmet need for health and fitness support of special needs teens and adults. Diets are often worse than average and there are few welcoming places to go. (Several CrossFit gyms are welcoming, but that's a big climb. This facility has grant support.)

We need more like this!

Tuesday, March 12, 2019

A (very) inclusive CrossFit gym - in Reno Nevada

Fitness is a problem for many people, not least special needs teens and adults. Diabetes and obesity are common in our population.

Diet is a factor — it takes a lot of cognitive work to outrun the American junk food industry. The special needs population is vulnerable to deceptive advertising implying health benefits of "sports drinks".

Exercise is also a problem. Special Olympics and Special Hockey programs are low volume — typically once a week. Group classes may be intimidating or unwelcoming. Incomes are low and gyms can be costly [1]. Workout music may be intolerable. The feel and odor of sweat may be unusually bothersome. Lastly, suffering for health is a bit abstract for many with special needs.

Today I learned of an extraordinary example of doing something more ...

Upstate Nevada - CrossFit Everyday Heroes

… Upstate Nevada is the first nonprofit facility for community fitness and is motivated by the philosophy that “nobody should be denied a healthy lifestyle due to physical, cognitive or financial impairments.” ...

… The Upstate Nevada board and staff run a community first, gym second … Inclusive and adaptive programs for any type of physical or mental impairments...

… Our Everyday Heroes program offers free or reduced price memberships for the following ...

-Adults with physical or cognitive impairments and their families

-Children with physical or cognitive impairments and their families

Wow. Very impressive. I’ve seen something a bit like this at CrossFit Icehouse in Fargo ND, but Upstate Nevada is at another level. I hope they share their learnings with the broader health and special needs community.

- fn -

[1] OTOH, adults on disability support often have to spend down to avoid asset caps — exercise classes and personal trainers can be a healthy option.

Sunday, January 27, 2019

How did the story end?

I started writing this particular blog in September of 2004. At that time Explorer #1 was 7 and #2 was 5. They are adults now.

The early years before this blog are a blur now. I think by the time I started writing we had developed a reasonably effective approach and seen some progress. The years between 2000 and 2004 were harder.

We aged a lot in those years.

Now this blog is infrequently updated. That’s partly because of my related book project, partly because adult Explorer challenges are personal, and partly because the complex educational and financial (SSD, etc) challenges we deal with now are managed by my wife — and she doesn’t blog. We’re specialized that way.

So the story continues, but the blogging is less frequent. For the few that have followed this blog I feel like I should provide a summary of sorts. For those who are starting on a similar journey it might help to know one ending, then maybe go back through past posts and pick out things of value.

In general our Explorers have done well. They are both adults, for now both have guardianship status. We have, to date, for the moment, avoided the catastrophes parents of special needs children justly fear.

#1 has cognitive disabilities. Once he was an “explosive child”. Now he reads and even writes a bit, albeit largely on his phone. He has two part time jobs (no benefits) and he has longterm disability status and thus some potential security after our deaths. He’s been a reliable employee. His self-regulation and planning ability continue to improve. He loves his family. His diet could be better; it’s a typical non-college US diet (i.e. terrible). He needs more exercise. He remains a pretty good athlete for someone who rarely practices.

#2 is on the classic autism “spectrum". He is in a post-secondary transition program and is a B/C student at our local community college (he’s fine with a C). Sadly he has shown zero interest in learning coding — the one path I think could lead to his financial independence. He is usually delightful but struggles with novelty, travel, and changes in routine. He has screen time issues but works them. His self-regulation continues to improve. His work capacity is limited, but growing. His diet and exercise are better than the US average. He is kind, sweet, compassionate, and a typical middle sibling peacemaker. His great strength is persistence. He has a bad day, but the next day he tries again.

Were I to have read this in 2002 I think I’d have felt relief. The story doesn’t end until the narrator dies; it could all change at any time. But for now, well enough.

Saturday, October 20, 2018

On autistic meltdown and exhaustion

Via Twitter I’m reminded of two autism blogs that have passed on - Musings of an Aspie (ended Jan 2015) and Everyday Aspie (2017)/Everyday Aspergers (2016). @mxmackpoet called out 3 in particular [1]:

- From the Inside Out: An Autistic Shutdown – Everyday Aspie Feb 2017

- Where I Go When I Shutdown | Musings of an Aspie Oct 2012

- Autistic Regression and Fluid Adaptation | Musings of an Aspie Dec 2013. This concept of transient autistic regression does not appear in the medical literature. Which speaks volumes about the miserable state of modern clinical research into autism in general, and post-pubertal autism in particular. I suspect the contribution of biology and environment varies by autism pathophysiology and age, but really we need the research.

All 3 match our family's experience from the (sort-of) neurotypical outside.

There is a lot of buried wisdom in these blogs written by people towards the neurotypical end [2] of the autism spectrum. It’s sad that these individuals no longer write on these topics, there really is no replacement for blogs and RSS notification mechanisms. I hope we reinvent them some day [3]. In the meantime I’ll use this post to remind me to explore. I hope one day our #2 will find these essays helpful.

- fn -

[1] It may not be chance that these 3 articles were written in dark times of the northern year.

[2] It’s not really a linear spectrum of course. It’s some multidimensional space we can’t visualize. People further from the neurotypical space aren’t able to communicate as clearly, these writers are translators.

[3] Or simply recultivate what still exists. Lots of things wax and wane over generations.

Wednesday, July 25, 2018

ABLE Plans and Special Needs Trusts

#1 is now on either SSI or SSDI or both. Yeah, we’re not sure. Might even have changed. This is a lot weirder than I expected.

There is, with one or the other, apparently a peculiar incentive for caregivers to retire at 62 rather than, say, 67 (something to do with family Social Security caps and spouses). There’s also something in there about Medicare with MA Backup after two years on SSDI, claims that it’s best to do at least one year of SSI before SSDI, 9 month income averages, retroactive payments that can be clawed back and so on.

The accounting is interesting — trying to stay below income and asset caps.

With SSI/SSDI we can get an ABLE 529A account so that he can save without running over his asset caps. The funds can only be used for things that improve health/mobility/function — but that’s could cover a lot of ground. Maybe mobile data services? Fitness services? Golf gear? Bicycle?

The best discussion I found on ABLE plans was in the respected Bogleheads forum:

You are not going to find any 529 ABLE plan with no annual account fee and expense ratios of 0.1%, certainly for non-residents. I call the reason for this the "529/HSA Effect". While they might be quite popular among Bogleheads, only a distinct minority of the population takes advantage of either of those plans. With volume comes competition and lower costs. Now consider the minuscule population eligible for 529 ABLE accounts. If they hadn't been smart and piggy backed on Section 529, they would be even more expensive.

ABLE plans will have the same pattern as the majority of HSA accounts. Their owners will be making a number of withdrawals throughout every year such as by a debit card. Compare this to retirement accounts, where most withdrawals only happen in retirement and then maybe once a year. This adds significant administrative costs.

529 plans, especially ABLE accounts can only be administered by a state. When does a state see money and not figure out a way to skim off the top. The dirty little secret is that a significant portion of program management fees goes to the state. For example, Maryland and Oregon take 0.30% in administrative fees themselves in their 529 ABLE plans.

The best I have seen so far is LA ABLE for Louisiana state residents only. No annual fee, no program management fee and 0.07%-0.15% for six Vanguard funds, including the four LifeStrategy Funds. There is a state alliance of GA, KY, MO, NH, OH, SC, and VT that offers funds with asset based fees of 0.31%-0.34% for those state's residents (0.57%-0.60% non-residents).

For non-residents the National ABLE Alliance of AK, CO, DC, IL, IA, IN, KS, MN, MT, NC, NV, PA and RI. Offers funds with asset based fees of 0.34%-0.38%. Their program management management fee is 32% and I'm sure the states gets a significant chunk of that. The underlying expense ratios are 0.02%-0.06% (based on fixed portfolios using Vanguard, Schwab and iShares funds/ETFs). They have a $15 ($11.25 e-delivery)/qtr account fee.

The best plan for non-residents based on cost might be Tennessee's ABLE TN, offering Vanguard and DFA funds with asset based fees mostly in the range of 0.35%-037% (Wellington at 0.35%) with no account fees. As always the devil is in the details. E.g. the plan does not offer a debit card.

Do your own due diligence. You can check all the available state 529 ABLE plans here. 529 ABLE Accounts

Ugh. Much higher fees than I’d hoped for.

We’re working on the special needs trust. We’ll probably use Vanguard to hold funds, have to dust off old Trust documents to create the trust. Good discussion on Trust and home purchases here.

Saturday, May 19, 2018

Catch 22: Special needs students in transition programs can't take community college classes in Minnesota

We’ve discovered an interesting “Catch-22. It applies to Minnesota but may be common elsewhere.

In MN a student entering a state funded transition program cannot do courses at a community college — even if they pay for them directly and even if they were doing them while in High School through Minnesota’s PSEO program.

The reason is that Community Colleges require a High School diploma, but transition programs require that a student not have a High School diploma [1]. While in High School students may attend Community Colleges for advanced courses through programs like PSEO (MN), but not after finishing High School. Once a student is in a transition program they may likewise, through the transition program, be eligible to attend selected community college classes.

This catch-22 won’t snag many students. Most students entering transition won’t have been doing PSEO classes or be interested in most community college courses. It may, however, catch autism-spectrum adults with relatively strong academic skills. Our #2 falls into this category.

We’re sorting out our options, but wish we’d known this in advance.

- fn -

[1] In practice though either adaptation or modification a MN student with an IEP (includes “special needs”) will typically have the credits to graduate. To maintain eligibility for transition program education for ages 18-21 the student may attend graduation, but the diploma is not placed in their hands. So, they finish High School at age 18, but they don’t actually graduate. This bizarre ritual must have its roots in the slow evolution of law and regulation. It might, for example, be rooted in an era where students “failed grades”; perhaps states chose 21 as a maximum age that anyone could spend in public high school regardless of grade. When post-secondary transition programs were created perhaps they were subsumed into this framework. I’m only speculating, but it would be consistent with how structures of law and regulation evolve.

Sunday, April 15, 2018

Adventures in Special Needs travel: Hawaii

The family went to Hawaii. Two special needs adults, one neurotypical daughter and two parents. There was a lot of planning work and a lot of on-the-fly adjustment. We chose Honolulu/Waikiki because our Explorers are more comfortable with concrete than with nature. The trip was a success, in part because, by sheer luck, the atypical rainfall spared both golf outings with #1.

Luck aside — some things that worked well:

- Direct flight. A five hour mechanical delay (Delta) was stressful though.

- Single residence located in Waikiki with kitchen and good parking. We ate most meals there. Nearby groceries. Many things we could walk to.

- Fairy detailed advanced schedule that we then swapped around based on weather.

- Copious research.

- Explorers now independent enough they could stay in hotel room or go off on their own in many settings.

- Private tour (“Oahu Private Tours" <jason@oahuprivatetours.com>). We got lucky with our guide too; #1 is on his best behavior with young women.

- We rented a van (very expensive in Hawaii by the way).

- Good attractions for our Explorers: Zoo, Aquarium, Waikiki beach, Paradise Cove snorkeling (quiet, no Hanauma stress), Foster Botanical Gardens (tranquility), Diamondhead hike, “Edge” restaurant hotel table that was near beach so we could mix food and sand…

- English language generally worked, McDonalds and Subway ubiquitous.

It was a very big expense of course few families could afford it. We did it this one time because we could manage cost and the children are leaving school settings, entering work, moving out soon, etc.

It’s perhaps useful to know this can be done — and the general approach might work for others. It’s a long way from our 2010 family trip to a nordic ski resort and 2008 road vacations but I don’t think we’re quite ready for, say, a week in Korea.